In the automotive parts industry, competition is never an easy game. Distributors are racing against time every day: the ones who can launch new products faster are the ones who win customers first; the ones who can keep purchasing and operating costs under control are the ones who can still hold profit margins during price wars.

In this process, distributors face a key decision: should they work directly with car mat manufacturers, or should they source through retail suppliers?

At first glance, both models may seem to meet supply needs. But in terms of cost, supply stability, communication efficiency, after-sales management, and long-term value, there are fundamental differences. This article will look at these angles in detail to help you decide which cooperation model is better for your long-term business growth.

Cost Comparison — Who Helps You Keep Your Profit?

Factory-direct pricing advantage from manufacturers

For distributors, profit always starts with controlling purchasing costs. Working directly with manufacturers means you get factory prices, without extra channel fees Gluebar OEM/ODM Solutions and without unclear markup steps.

More importantly, most manufacturers offer tiered pricing or annual agreements for long-term partners. This not only saves more on large orders but also locks in stable prices, avoiding cost overruns caused by raw material fluctuations. For distributors, this model is like putting the “ledger” right on the table—raw materials, labor, molds, and logistics can all be calculated clearly, leaving no surprises.

In other words, choosing factory-direct supply is not just about saving on one order. It helps build a more stable and transparent cost structure throughout the entire cooperation cycle (see Gluebar product catalog).

Layered markups from retail suppliers

By contrast, sourcing from retail suppliers is a different story. Retail suppliers are not at the production end. They need to buy from factories and then add their own warehousing, channel, and operating costs. By the time these costs are passed on to distributors, prices have already gone up.

In this model, even if the product itself doesn’t change, your profit margin gets eaten away step by step. For small or emergency orders, retail channels may be convenient. But for long-term cooperation, they become a heavy burden. Higher costs not only reduce your price competitiveness but also weaken your bargaining power against peers.

Simply put, retail suppliers are more like a “backup option” for temporary restocking, not a reliable partner for long-term business growth.

Supply and Stability — Can Market Demand Be Met Continuously?

Large-scale capacity and inventory support from manufacturers

For distributors, the ability to deliver on time and in full directly affects whether customers place repeat orders. Mature factories usually have strong production capacity: monthly output can reach tens of thousands or even 100,000 sets, with standard lead times of 15–20 days. Even during peak seasons, they can secure delivery through scheduling and overtime, so customers don’t have to “wait forever.”

Even more importantly, manufacturers guarantee batch consistency. Whether it’s materials, colors, or process standards, everything stays uniform. This means fewer returns, a better customer experience, and stronger reputation for distributors.

Many manufacturers also keep safety stock or prepare raw materials in advance for long-term clients. If a sudden large order comes in, they can respond quickly. This kind of “hidden guarantee” is something retail channels can hardly offer.

Uncertainty with retail suppliers

Retail suppliers often carry greater risks when it comes to supply stability:

Dependence on third-party channels: They don’t have production capacity themselves and rely on upstream suppliers. If the supply chain fluctuates, they face shortages.

Batch inconsistency: The same car mat model may differ in color or thickness because of different sourcing channels. While consumers may overlook this, for distributors it directly affects satisfaction and may cause returns.

Limited stock: Retail channels are usually only suitable for small orders. When it comes to large or long-term orders, stock-outs and supply breaks are almost inevitable.

For distributors who rely on steady supply to maintain their market position, these uncertainties are a potential business risk.

Communication Efficiency and Customization — Who Can Help You Respond Faster?

Direct communication advantages with manufacturers

In B2B business, customer demands are often specific and urgent. For example, a client may request a logo embedded on the mat, or a multi-language installation guide. If too many layers are involved, these needs get passed around repeatedly, sometimes even distorted, wasting valuable time.

By working directly with the manufacturer, you connect straight to the R&D and production teams. Requests can be translated into drawings, molds, or production tasks immediately. A change proposed today can be confirmed and responded to tomorrow.

Manufacturers also hold first-hand information: how much raw material is in stock? How long will production take? Can the order be expedited? These details can be answered in real time. The more transparent the data, the more accurate your decisions, and the faster projects move forward. For distributors, this means fewer detours and fewer mistakes caused by information gaps.

Put simply, dealing directly with manufacturers gives you the “first-hand answers,” not second-hand messages passed along. In a competitive market, that’s an efficiency advantage.

The limitations of retail suppliers

Retail suppliers mainly sell ready-made stock. Most of the time, what they can say is: “This batch is available, but we’re not sure when the next one will arrive.” If customers ask for special requirements, like a unique color, retail suppliers often cannot deliver, or they take a long time to find it.

Another issue is slow information flow. Since retailers don’t make products, they don’t know raw material levels, process details, or delivery cycles. If you ask, “When will it arrive?” they often need to check with their upstream supplier before replying. By the time the answer reaches you, the best window to react may already be gone.

For distributors, these limits mean:

Customization is basically off the table; you can only choose from existing stock.

Slow responses risk missing market opportunities. For example, a new car model launches, and competitors already have mats on the shelves while you’re still waiting for updates.

In short, retail suppliers may work for small or occasional purchases. But when it comes to customization, scale, or quick reaction, their weaknesses become very clear.

Long-Term Costs and After-Sales Management — Who Helps You Cut Hidden Expenses?

Material and certification advantages of manufacturers

From a long-term business view, durability and compliance directly shape distributors’ after-sales costs and market reach.

Good manufacturers often use eco-friendly TPE material. It is durable, waterproof, non-slip, and odor-free. Compared to ordinary PVC mats, its lifespan is much longer. This means customers don’t need frequent replacements, which naturally lowers return rates. With fewer returns, distributors save heavily on logistics, restocking, and after-sales service.

In addition, reputable manufacturers usually hold international certifications such as ISO9001 and IATF16949.

These not only prove that factory quality management meets global standards but also open doors for products to enter markets in Europe, Southeast Asia, and the Middle East. For distributors, this reduces risks caused by certification gaps.

After-sales risks of retail suppliers

By contrast, sourcing from retail suppliers carries much higher risks. Mats from retail channels are usually bulk stock from various sources, with uneven quality. Durability is often a problem—some wear out, deform, or smell bad in just a few months. These issues lead to complaints and returns. Returns not only create direct losses but also consume a lot of time and energy to resolve.

Worse, retail suppliers often lack complete testing reports or technical support. If a customer asks for quality certificates or faces product problems, distributors have to take on the risk themselves. This may mean paying for third-party testing, or continuing sales at the cost of reputation damage. Either way, operational costs climb higher.

So while retail suppliers may look convenient in the short term, in the long run they bring “hidden costs” in after-sales and can even damage your customer reputation and market credibility.

Strategic Partnership and Future Growth — Who Can Go Further With You?

One-stop supporting services from manufacturers

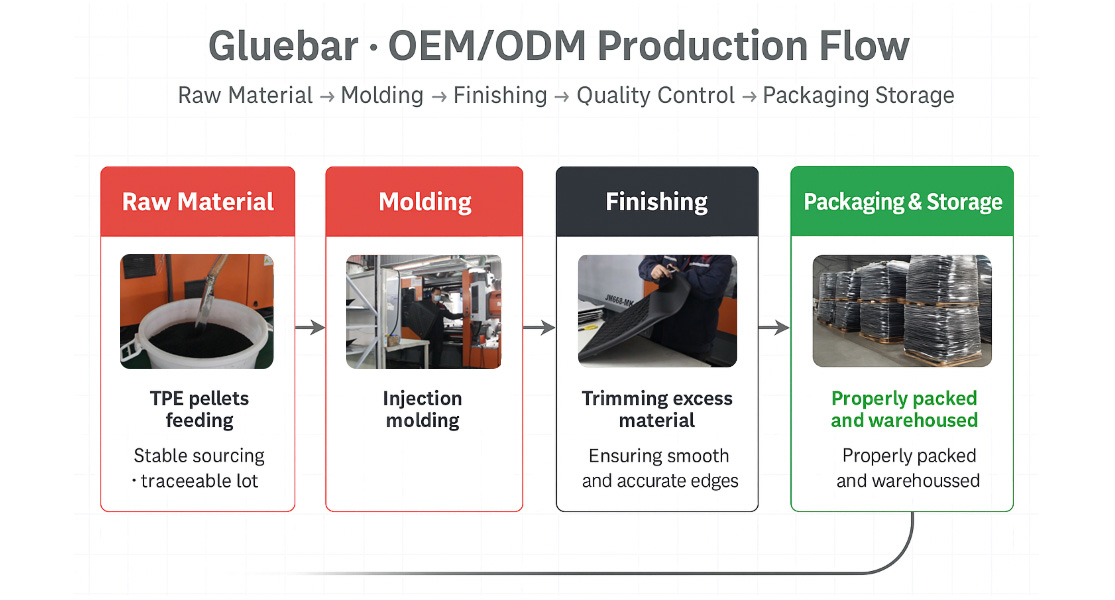

For distributors, choosing a partner is not only about one order at hand. It’s also about long-term growth. Manufacturers can provide OEM/ODM one-stop services, covering the full process from mold development and sample approval, to mass production, packaging design, and international logistics. This means distributors don’t have to coordinate with multiple suppliers. One partner can handle the entire chain.

As cooperation deepens, manufacturers also tend to give more support, such as:

Flexible payment terms to ease cash flow pressure

Flexible inventory and delivery arrangements, like batch shipments or warehousing support

Market and branding support, such as product materials, trade show cooperation, or promotional content

These supporting advantages make manufacturers more than just suppliers. They become strategic partners for business growth. As your scale expands, the manufacturer’s capacity and resources can grow with you, ensuring the relationship stays balanced and stable.

The limits of retail suppliers

By contrast, retail suppliers are more about “short-term supply.” They can quickly meet small-scale or short-term stock needs, but they offer almost no strategic value. As distributors grow, retail suppliers cannot match in capacity, customization, services, or market support.

In the long run, retail channels are only suitable for small orders or market testing. Once the business scales up, retail suppliers often become a bottleneck that limits growth.

The Bottom Line

Manufacturers and retail suppliers both have their places: retail channels may suit small, short-term restocking, like market testing or urgent needs; but factory-direct supply is far better for long-term, large-scale cooperation.

For B2B distributors, working directly with manufacturers clearly holds more advantages. It helps save purchasing costs and time, while also offering stronger guarantees in supply stability, product quality, customization, and after-sales support. More importantly, manufacturers can bring long-term strategic value, helping you stay competitive in a tough market.

In the auto parts industry, profit margins depend on cost control, while customer satisfaction depends on delivery speed and quality. Choosing manufacturers means securing greater profit, stronger customer trust, and broader opportunities for growth. Contact Gluebar today to get a custom solution.